Earlier this year, we noticed that some LM-20 forms were being filed in a timelier fashion and earlier this month we decided to systematically determine whether there was any substance to this impression. Turns out, there was. Using LaborLab’s LM-20 database for all LM-20 filings through 8/3/23, we filtered out duplicate LM-20 filings by the same consultant (many times, consultants file a second or third LM-20 for the same employer where they hire additional subcontractors or there are changes in the scope of work).

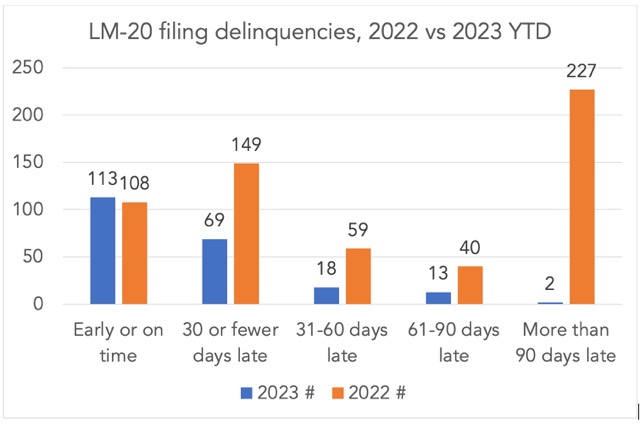

After this, we found that of 215 unique LM-20’s filed so far in 2023 (through August 3, 2023), 113 or 52% of them were filed early or on time, compared with only 18.6% of those filed for all of 2022.

Nearly 85% of 2023 LM-20s filed year to date have been filed early, on time or only 30 days late, compared with 44% for all of 2022. Perhaps most significant, as shown in the chart below, is that filings later than 90 days have all but been eliminated in 2023 so far, compared with nearly 40% of all 2022 filings falling into this delinquency category.

While this dramatic improvement of on-time filing for LM-20s so far in 2023 may be cause of celebration, there is still much to be done. First, many LM-20s are deficient in any number of ways, such as not including any information on hourly or daily fees or reporting the union and local number. Second, based upon the number of LM-20s filed in 2021 and 2022, LaborLab has determined the number of LM-21s (consultant’s annual report) and LM-10s (employer’s annual report) owed and compared that with forms filed. The filing of just one LM-20 triggers the corresponding requirement that the employer file an LM-10 for the same fiscal year, even if no payments were made to the persuader. By the same token, the filing of just one LM-20 triggers the requirement that the consultant file an LM-21 or annual report. Both LM-10s and LM-21s are due within 90 calendar days of the close of the fiscal year.

For consultant annual reports, as of August 3, 2023, LaborLab has determined that there are fifty-eight (58) LM-21s owed but not filed from 2021 and 34 owed but not filed for 2022.

For 2021, LaborLab has determined there are 47 LM-10s still owed for 2021 (down from 54 as of March 31, 2023—a year after their deadline); for 2022 LM-10s owed, 78 still have not been filed.

The current Administration and the Office of Labor Management Services (OLMS) clearly deserves our recognition for increased outreach and voluntary compliance with persuaders to improve timely filings, but there is still much to be done. First of all, on-time filing can always be improved (50% is still a failing grade), particularly with the time critical Form LM-20, which is needed by workers and unions in the throes of an organizing campaign.

OLMS needs to follow-up more intensively with consultants and employers alike to file their LM-21s and LM-10s, without which we cannot gain a complete understanding of how much money persuaders are receiving and how much employers are paying for their services.

Lastly, it is important to acknowledge that LaborLab stands as the sole nonprofit watchdog organization dedicated to monitoring anti-union persuaders. Our relentless efforts have not only led to a substantial enhancement in on-time LM-20 filings but have also contributed to heightened scrutiny of anti-union persuaders by both media outlets and government agencies. This progress, made possible by the steadfast grassroots and worker support we’ve garnered over the past two years, underscores the pivotal role LaborLab plays. While we have made strides in holding untimely filings accountable through numerous complaints, our mission remains far from finished. With your continued support, we remain committed to furthering the transparency and disclosure of persuader activities.