The Office of Labor-Management Standards (OLMS) has published a final revision to the Form LM-10 Employer Report. This rule will go a long way to help enforce President Obama’s Executive Order 13494, which states:

It is the policy of the executive branch in procuring goods and services that, to ensure the economical and efficient administration of Government contracts, contracting departments and agencies, when they enter into, receive proposals for, or make disbursements pursuant to a contract as to which certain costs are treated as unallowable, shall treat as unallowable the costs of any activities undertaken to persuade employees—whether employees of the recipient of the Federal disbursements or of any other entity—to exercise or not to exercise, or concerning the manner of exercising, the right to organize and bargain collectively through representatives of the employees’ own choosing. Such unallowable costs shall be excluded from any billing, claim, proposal, or disbursement applicable to any such Federal Government contract (emphasis added).

On August 27, 2023, a new U.S. DOL rule will make very slight but significant changes in the Form LM-10 Employer Report.

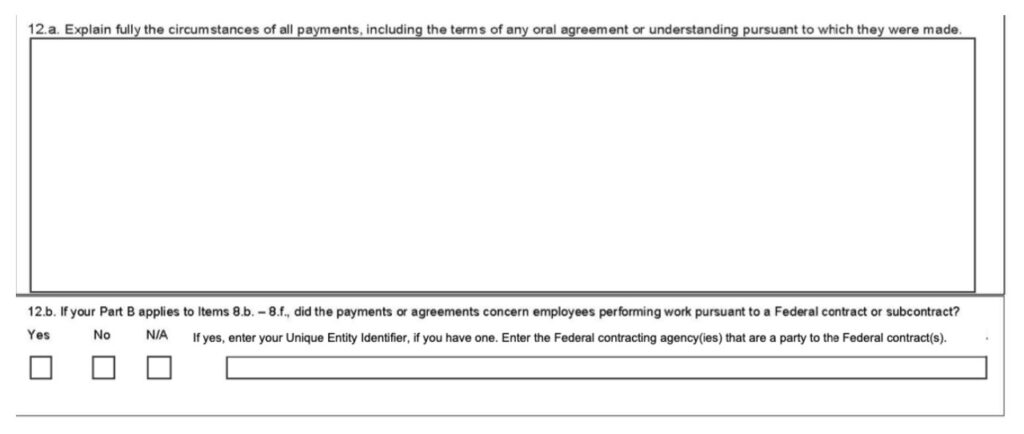

Originally proposed last year and supported by LaborLab, the new final rule, issued July 28, 2023, will emphasize something already in the instruction and add a single “yes/no” check box for employers to indicate whether they are federal contractors or subcontractors; if they are, they will have to provide a specific identification number and list the federal contracting agency.

A very complete and succinct statement of the changes made in Form LM-10 by the new rule is found on page 77 of the Final Rule:

The Department adds a checkbox to the Form LM-10 reporting requiring certain reporting entities to indicate whether they are federal contractors or subcontractors. If so, the report will direct the filer to indicate the federal contracting agency and the contractors Unique Entity Identifier (UEI), if the contractor has one. The Department will also clarify in the Form LM-10’s instructions that a filer must identify the subject group of employees (e.g., the particular unit or division in which those employees work). This information has always been compassed by Item 12 and the revised instructions now explicitly require it for item 12.a.

Stay tuned to LaborLab when we’ll show you how to use www.usaspending.gov to locate the details (dollars, dates, descriptions of federal contractors) when employers check the “yes” box (see below) in 12.b. We’ll also describe how to use the LM-10 in conjunction with E.O. 13494 which makes expenditure of persuader dollars non- reimbursable for Federal contractors and file complaints with Federal agency inspector

generals and develop related campaigns.

Here is what the revised Form LM-10 will now look like: