On September 13, 2022, the US Department of Labor published a Notice of Proposed Rule Making (“NPRM”) in the Federal Register regarding a small addition to Form LM-10, the annual report filed by employers covered by the Labor-Management Reporting and Disclosure Act (“LMRDA”) who make certain types of payments to unions, union officials, employees, or consultants. The proposed regulation itself may be found online. If you wish to submit comments on the proposed rule, you must do so within thirty days, or October 13, 2022, using this link.

Note that this is only a proposed rule. After the comment deadline, OLMS must review all the comments, draft a final regulation and have it pass through multiple levels of review before it can become final.

| What does the proposed rule do exactly? The proposed rule would add a section 12(b) in which each filer (other than those reporting payments to unions or union officials) check a “Yes/No” box as to whether they are a current Federal contractor or subcontractor. If they are not and check “No”, then that’s it. But if they check “Yes”, then they must provide a Unique Entity Identifier (UEI) number which is assigned by the General Services Administration to all Federal contractors. And as you can see from the screen print below, those ticking the “Yes” box must identify the Federal contracting agency. Here’s the only change to the current LM-10 form, the addition of Section 12(b). |

|

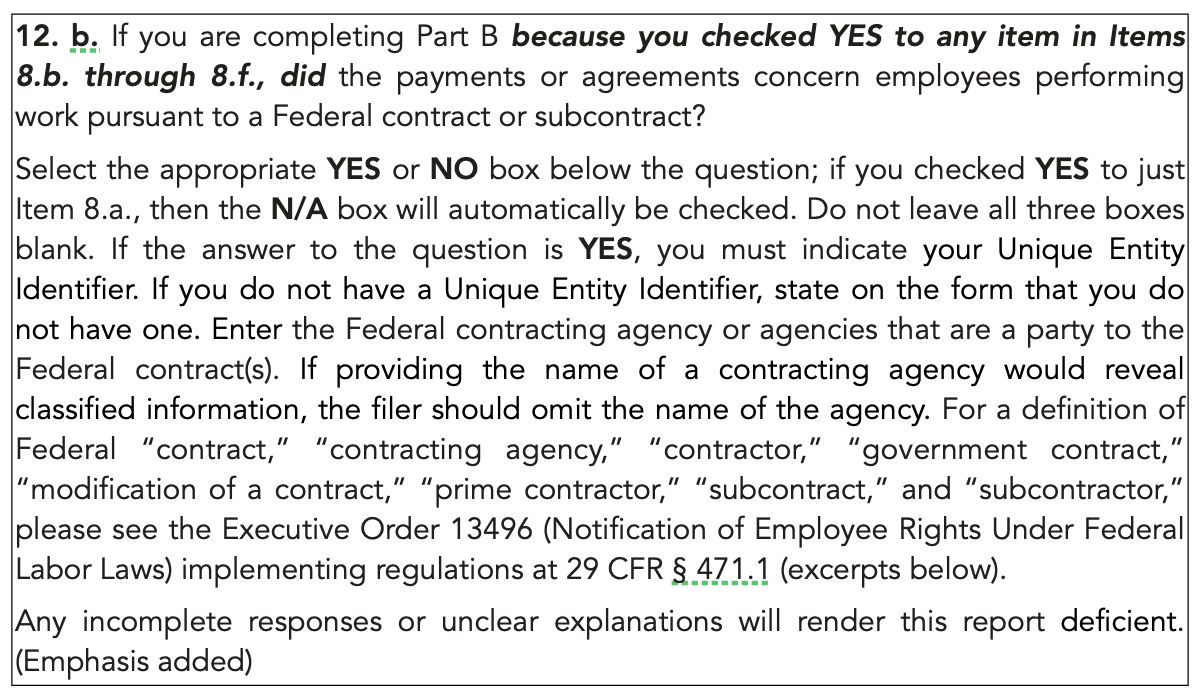

| The instructions of the proposed new form have added a section 12(b): |

|

| The new rule also adds one additional phrase to the instructions in item 12 (now proposed as item 12(a). This additional phrase instructs all filers (not just those with Federal contracts or subcontracts) in their description of the reported activities for “fully identifying the subject group of employees (i.e., the particular unit or division in which those employees work).” This additional emphasis is important because it’s quite difficult to determine from most LM-10s (or LM-20s) exactly what division, location or department is the subject of the reportable employer activity. The remainder of the form and the instructions are unchanged, including language at the end of section 12 which indicates “any incomplete responses or unclear explanations will render this report deficient.” Why the focus just on Federal contractors and subcontractors? Part of the answer lies in a pair of almost forgotten Executive Orders signed by President Obama on January 30, 2009: No. 13496 and No. 13494. Under Executive Order No. 13496, all Federal contractors and subcontractors (except those with prime contracts under $100,000 and subcontracts under $10,000) were required to post a notice for employees regarding their rights under the National Labor Relations Act and providing examples of unlawful employer contact. For a copy of the notice, go here. In the companion Executive Order 13494, President Obama declare the policy of the Federal government to promoting |

| economy and efficiency in Government contracting, certain costs that are not directly related to the contractors’ provision of goods and services to the Government shall be unallowable for payment, thereby directly reducing Government expenditures. This order is also consistent with the policy of the United States to remain impartial concerning any labor-management dispute involving Government contractors. This order does not restrict the manner in which recipients of Federal funds may expend those funds. Sec. 2. It is the policy of the executive branch in procuring goods and services that, to ensure the economical and efficient administration of Government contracts, contracting departments and agencies, when they enter into, receive proposals for, or make disbursements pursuant to a contract as to which certain costs are treated as unallowable, shall treat as unallowable the costs of any activities undertaken to persuade employees—whether employees of the recipient of the Federal disbursements or of any other entity—to exercise or not to exercise, or concerning the manner of exercising, the right to organize and bargain collectively through representatives of the employees’ own choosing. Such unallowable costs shall be excluded from any billing, claim, proposal, or disbursement applicable to any such Federal Government contract. |

| It is not immediately apparent if these two Executive Orders were ever rescinded, so they still state a clear Federal government policy against using taxpayer dollars to support persuader activities and other employer violations of workers right to organize and bargain collectively. It is also unclear what actions have been taken in the past twelve years against Federal contractors and subcontractors. However, failures of Federal contractors and subcontractors to post the notice are still subject to complaint and investigation by OLMS. What is the purpose of the Form LM-10? According to OLMS in the text of the NPRM, the Form LM-10 reporting requirement is based on Congress’s dissatisfaction with the “large sums of money [that] are spent in organized campaigns on behalf of some employers” on persuader activities that “may or may not be technically permissible” and Congress’s determination that the appropriate response to such persuader campaigns is to disclose them in the public interest and for the preservation of “the rights of employees.” The form is a multi-purpose form. In Section 8 of the Form, there are a series of “yes/no” questions regarding types of reportable activity. If just one box is checked, the employer must file a Form LM-10 for that fiscal year. The form is due within 90 days from the close of the year’s end. Most of the LM-10 reports are for item 8(a), which are payments to unions and union officials for things like reimbursed travel. Next most prevalent is 8(E) which is for persuader activity. But payments to employees to engage in persuader activity (8(B)) is one of the choices, as is payments for information about employee or union activities in labor disputes and payments to consultants for information about employees or unions involved in a labor dispute with the employer. The form requires itemized reporting of all payments, loans, etc. and the method of payment in item 11 and the details of the payments in item 12. So why is OLMS doing something about LM-10 reporting now? According to the NPRM, |

| of, and public interest in, persuader activities in recent years. The media, academics, and non-governmental organizations (NGOs) have taken note of persuader activity in a number of industries, including multiple high-profile instances of companies investing substantial resources in persuader activity. Over the decades, employer efforts to defeat unions have become more prevalent, with more employers turning to union avoidance consultants. Further, members of Congress have noted recently that Federal contractors have engaged in such agreements and activities. |

| Current OLMS Director Jeffrey Freund announced on January 5, 2022 that OLMS was planning to step up enforcement of reporting and disclosure provisions for persuader activity and this sentiment is mirrored in an additional justification from OLMS in the NPRM: “The Department is acting because it has a clear interest in understanding the full scope of activities undertaken by employers that enter into agreements to persuade employees not to exercise these rights, including whether they benefit from Federal contracts.” The reason for focusing the Form change on Federal contractors and subcontractors is based largely on Executive Order 13494: “See Executive Order (E.O.) 13494 (reiterating ‘the policy of the United States to remain impartial concerning any labor-management dispute involving Government contractors.’). Such Federal contractors are not permitted to receive reimbursement for the costs of engaging in those activities under the contract.” What does this mean for us? Even though the wording of the proposed change may seem insignificant, the implications are far-reaching, provided the OLMS does indeed step up its enforcement of reporting and disclosure provisions of Forms LM-10, as well as LM-20 and -21. As noted in earlier issues of this Update, many employers identified in 2021 LM-20s filed by persuaders haven’t yet filed their LM-10 which were due March 30, 2022. In many cases, the persuaders have attached electronic copies of the letters of engagement with the employer and the employer still hasn’t filed their LM-10. And in a few more cases, several persuaders who still itemize receipts from employers have identified non-filing employers, as well as the final payment dates and total amounts received—but still no LM-10s. Whether it’s a problem of inadequate staffing or competing resources, if OLMS is truly serious about this change, they need to make employers comply. Turning to the potential of identifying government contractors, readers must realize that a surprising number of employers in the US are Federal contractors and subcontractors. Trucking and airlines haul cargo for the US government and military; warehouses and distribution centers ship groceries and other goods under contract to the US government; heavy and highway contractors build highways, airports, bridges, and dams under contract to the US government; insurance and financial service companies have many Federal government contracts. If the rule does become final, and LM-10 reports are filed by companies reporting these payments, there may be a whole new way to confront not only persuaders, but those employers who would seek to deny workers the union representation they desire. |